Canada.ca Benefit Payment Dates 2025: Everyone is excited for the alluring government benefits they are going to get. CRA and Service Canada is all set for reducing the financial pressure from the Canadians. These financial assistance are proven as helping agents in managing the household expenses like grocery cost, rent, childcare expenses, electricity expenses etc.

The Canadians who are eligible they will receive these benefits as per the schedule through Service Canada and the Canada Revenue Agency. There are several payments are set for the June to be disbursed. The nearby payments which is going to be disburse to the Canadians are OTB or Ontario Trillium Benefit, Canada Pension Plan or CPP, CCB or Canada Child Benefit, Old Age Security or OAS and the Veteran Disability Pension in this month. To manage the effective rise in the cost of living, these benefits will help them. The Canadians will receive the following payments in June and I am noting down some of these.

Canada.ca Benefit Payment Dates 2025

OTB or Ontario Trillium Benefit June 2025

OTB is a monthly stimulus check that is provided to the Canadians those who are living with low to moderate incomes.

- OEPTC or Ontario Energy and Property Tax Credit

- Northern Ontario Energy Credit (NOEC)

- Ontario Sales Tax Credit (OSTC)

The eligible candidates have to file the tax return and qualified for at least one of the credits. The applicants have to be resided in Ontario. This credit is tax free.

The applicant may qualify for one of three types of credits, and the amount they will receive depend on factors like age, marital status, and property tax paid etc.

CCB or Canada Child Benefit June 2025

CCB or Canada Child Benefit is a monthly financial assistance given to the families who are having children under 18 years of old and this is given just to help them in raising their child well. This is a tax-free benefit avail by the parents to meet their day to day requirements like food, clothing, and school supplies.

- The beneficiary has to be a resident of Canada and a care giver.

- There must be a child whose age should be 18 years of old.

- The qualified families will get the payment on 20th of June.

- Previous year the child tax was increased by 4.7%.

- The families having children under 6 years of age will get $648.91 per month and $7787 yearly and at the mean while the children aged 6to 17 can receive up to $648.91 per month and$6,570 annually.

SNAP Monthly Payment For June 2025: What’s New This Month?

R3070 SASSA Grants July 2025: Check Payment Dates, Eligibility & Income Limits

CPP or Canada Pension Plan June 2025

CPP or Canada Pension Plan is a monthly retirement pension plan which is given to the eligible Canadians after their retirement. The recipient needs to be 60 years of old to get the benefit. The beneficiaries have to made contribution towards the CPP. This benefit is treated as a dependable income source for Canadians who contributed throughout their careers.

- The payment will be credited in the beneficiary’s account on 26th of June.

- The stimulus check varies and it depends up on the contributions made by the applicants, their work history, and the age at which they have started.

- If a recipient have started at his 65 years, then he will get a maximum amount of $1,433,

- On an average the recipient will get approximately $900 per month.

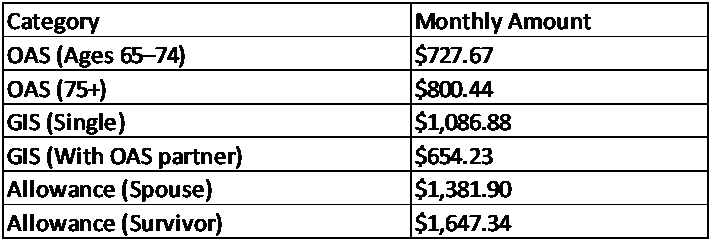

OAS or Old Age Security Payment June 2025

Old Age Security plan is a monthly financial assistance given to the Canadians based on their work history.

- It is calculated on the basis of age, income, and how long a person has lived in Canada, with extra supplements available for low-income seniors.

- The applicant has to be a resided in Canada for minimum of 10 years after turning 18 and should be 65 years of old.

- Most people are automatically enrolled, but you should apply if you do not receive information from Service Canada by the age of 64.

The recipients will get the payment on the account on 26th of June.

- They will receive a maximum of $727.67 who are aged between 65-74 years old and $800.44 who are 75 and older.

- The single ones will get $1,086.88 and the married ones will get $654.23 under GIS scheme.

- The couple who are receiving both OAS and GIS, they will get $1,381.90 and the individual who is a survivor will get $1,647.34.

VDP or Veteran Disability Pension Payment 2025

This payment is managed by Veterans Affairs Canada. This is a monthly payment provided to disable veterans. Especially this payment is meant for those who were injured during military duty. This support is available to veterans of the Canadian Armed Forces and those who served in WWII or the Korean War, certain members of the RCMP, and wartime civilians.

- The benefit amount is dependent on the severity of the disability, the highest amount for a Class 1 rating is $3,444.59 per month.

- The date of disbursement is 27th of June.

$6000 SSDI & Social Security Payment In June 2025: Check Payment Date, Eligibility And Benefits

Social Security Cuts 2025: US Government Reverses The Cuts Made To These Recipients

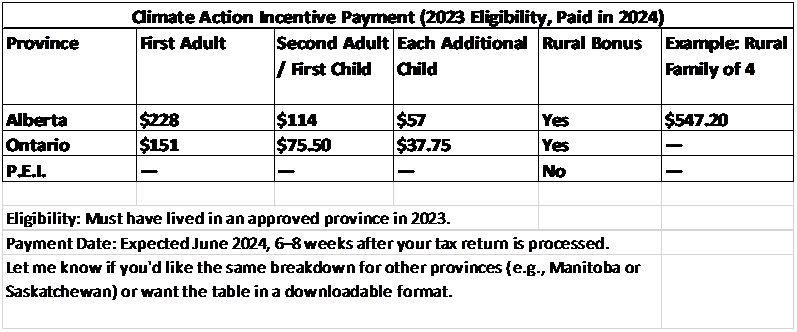

Canada Carbon Rebate or CCR June 2025

It is a tax free payment which is paid quarterly and meant to help offset federal carbon taxes.

Actually this program is officially closed on April 22, 2025 after when the government eliminated the consumer carbon tax. But the late filers of 2024 may still receive their final payment in June. The living Canadians who are following the federal pollution pricing like Alberta, Manitoba, and Ontario who filed their 2024 taxes after April 2, 2025 also can qualify.

So if you are preparing for June then, then make sure to check your eligibility and to avoid any delays in receiving your benefits ensure that your tax returns are submitted and all required information is current with Service Canada or the CRA.