$3000 OAS Pension Increase in 2025: A potential $3,000 annual increase in the Old Age Security (OAS) pension has sparked widespread attention among Canadian seniors in 2025. With rising inflation and cost of living, retirees are eagerly awaiting confirmation of this proposed enhancement, which could significantly improve the financial stability of those aged 65 and above.

While the increase is still under consideration and not officially confirmed, this guide explains everything we know so far, including eligibility, payment schedules, benefit amounts, and how seniors can maximize their OAS Pension in 2025.

$3000 OAS Pension Increase 2025

The proposed $3,000 enhancement would be an annual boost to the current Old Age Security pension, aiming to assist seniors who are struggling with basic living costs amid rising inflation. Currently, the OAS program provides a monthly payment to Canadian seniors aged 65 and older. If implemented, this increase would mean an additional $250 per month, helping low-income and fixed-income seniors meet essential needs.

Status: As of July 2025, the $3,000 OAS pension increase is not yet confirmed by the Government of Canada.

Current OAS Pension Rates (2024–2025)

| Age Group | Monthly OAS (2024) | Annual Total | Proposed Annual with $3,000 Boost |

| 65–74 | $727.67 | $8,732.04 | $11,732.04 |

| 75+ | $800.44 | $9,605.28 | $12,605.28 |

These rates are reviewed quarterly and adjusted based on the Consumer Price Index (CPI).

Property Tax Breaks For Retirees: Not New York or California Only These States Offers It

$2.5M Apple Federal Credit Union Settlement 2025, Who and How to Claim?

Administering Authority & Funding

Proposed by: Government of Canada

- Administered by: Canada Revenue Agency (CRA)

- Delivery: Direct deposit or mailed cheque

- Official Website: canada.ca

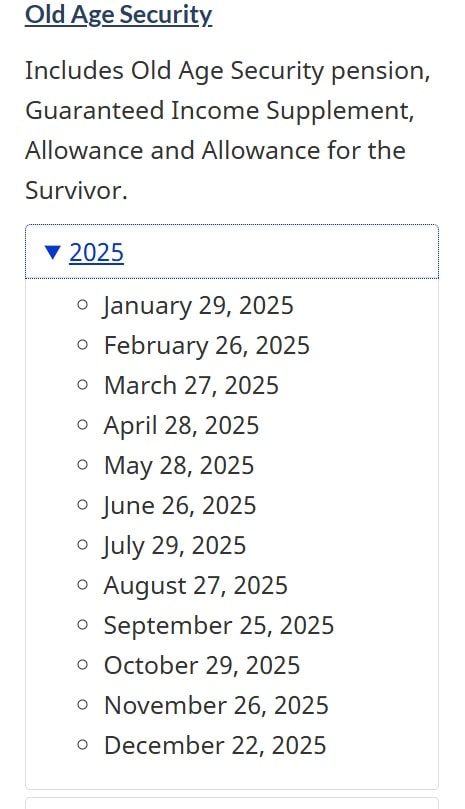

OAS Pension Payment Dates for Late 2024 & 2025

Here are the upcoming OAS Pension payment dates :-

Ensure your direct deposit information is updated to avoid delays.

Eligibility Criteria for OAS Pension in 2025

To be eligible for the Canada Old Age Security (OAS) Pension, applicants must satisfy the following requirements:

Age Requirement: Applicants must be at least 65 years of age.

Citizenship and Residency: Eligibility is restricted to Canadian citizens or permanent residents who are residing in Canada at the time of their application.

Duration of Residency: Applicants are required to have resided in Canada for a minimum of 10 years after reaching the age of 18. Those who have lived in Canada for 40 years are entitled to receive the full OAS benefits.

Income Limitations: OAS benefits may be reduced if the applicant’s annual net income surpasses specified thresholds:

For individuals aged 65 to 74, a net income below $148,451 qualify them for benefits of up to $8,732 annually.

For those aged 75 and older, a net income below $154,196 allows for benefits of up to $9,605 annually.

These eligibility criteria are designed to ensure that the benefits are directed towards individuals who are most in need.

How the OAS Payment Amount Is Calculated?

The amount you receive from OAS depends on:

- Your age group (additional supplement for 75+)

- Your net annual income

- Your residency history in Canada

OAS is not tied to employment history and is considered a non-contributory pension. Payments are adjusted quarterly based on inflation using the Consumer Price Index (CPI).

How to Apply for $3000 OAS Pension Increase in 2025

Seniors can apply online or via paper forms through the Government of Canada website:

Step-by-Step Application Guide:

- Visit canada.ca.

- Check eligibility: Age, residency, and income criteria.

- Complete the application form accurately.

- Attach documents:

- Proof of age

- Residency history

- Income verification

- Submit the form online or mail it to Service Canada.

- Provide direct deposit details to ensure timely payments.

- Monitor application status through your My Service Canada Account (MSCA).

- Respond to any requests for additional documentation from CRA promptly.

How to claim for the benefits?

Seniors who meet the eligibility requirements can initiate their application for Old Age Security (OAS) Benefits by adhering to a series of outlined steps.

Firslty, Access the official government portal by visiting canada.ca and navigating to the section dedicated to OAS. After that, Verify that all eligibility criteria are satisfied, which includes age, residency status, and income limits. Now Accurately complete the necessary application forms, ensuring that all personal and financial information is correct. After That, Gather and attach all required supporting documentation, such as proof of residency and income verification. After that, Provide banking details to establish direct deposit, facilitating prompt receipt of payments. Now, Submit the fully completed application and keep track of its progress through online monitoring.

The Canada Revenue Agency (CRA) is responsible for the distribution of OAS payments, highlighting the importance of submitting precise information. Ensure that all forms and documents are submitted within the designated time frame to avoid delays in benefit receipt. Regularly check for updates or requests for additional information from the CRA to ensure a smooth application process.

How to get the most updates of payments?

- Create a budget. If you rely on your OAS benefits to get you through the month, make sure you have a budget. A budget is a plan for your money.

- It helps you to find out how much money is coming to you.

- Automate your OAS payments.

- By automating your payments you’ll know exactly when the money will arrive in your bank and you’ll be able to avoid the hassle of depositing checks.

Fairlife Lawsuit 2025: What’s the Allegations? All You Need to Know

SA Triple Payment in July 2025? Fact Check & Real Details for SSI, SSDI, and VA Beneficiaries

Overview

With OAS benefits, most Canadians meet the eligibility details for these pensionable benefits. You can start receiving these federal benefits at age 65, while other pensionable benefits are available at age 60. Although there is a maximum amount you can receive from Old Age Security benefits, people who are considered low-income seniors can receive additional benefits.

FAQs on $3000 OAS Pension Increase

Is the $3,000 OAS increase confirmed?

No, as of June 2025, it is proposed and unconfirmed.

Who would benefit from the increase?

Primarily low-to-middle-income seniors who are already receiving OAS and meet eligibility requirements.

Will the increase be automatic?

If passed, the CRA would likely adjust payments automatically for eligible recipients. No reapplication would be needed.

Is there any action required now?

Seniors should ensure their OAS information is updated and continue to monitor official updates from canada.ca.

What happens if my income exceeds the clawback limit?

Your OAS payment will be gradually reduced, and at higher levels, fully clawed back.