Kenya Revenue Authority changes 2025: The Kenya Revenue Authority has extended the last date for filing income tax returns for the year 2024 in Kenya from June 30 to July 5, 2025. This new step has been taken in view of the technical problems on the itax portal and the increasing demand for filing returns. Let us tell you that the authority had earlier fixed June 30, 2025 as the last date for filing income tax returns, but due to the last date, many taxpayers started using the itax portal simultaneously, due to which the itax system could not bear the load of so many applications and many taxpayers were unable to pay tax on time.

Due to repeated technical problems, many taxpayers also demanded to extend the last date, due to which the Kenya Revenue Authority has now extended the last date for filing income tax returns to July 5, 2025. Meaning now Kenya taxpayers will be able to pay their taxes by July 5, 2025. Along with this, Kenya Revenue Authority has also made another new announcement because this problem came due to technical reasons, so the taxpayers stuck in technical reasons will no longer need to pay interest and penalty due to late payment.

Kenya Tax Filing Last Date Extension

As we told, Kenya Revenue Authority has now made the last date for paying tax 5 July 2025. This new decision has been taken keeping in view the convenience of the taxpayers. Many taxpayers could not pay on time due to technical difficulties, so now taxpayers are being given time till 5 July 2025. All those taxpayers who pay their tax by 5 July 2025 will not need to pay interest and penalty for late payment, but such taxpayers who are unable to submit their tax return by the stipulated time limit will have to pay both interest and penalty.

We all know that the tax system is a very important system for the stability of any nation. To run the nation smoothly, the government there collects taxes from the citizens and this tax is the central pillar of the ability of governance. But if the citizens are unable to pay the tax on time, then the whole country is affected by it. The benefit of various types of public services is made available to the citizens through this fund. In such a situation, such tax payments are very important to keep the economy of any country running smoothly so that development projects can be conducted. But many times citizens are not able to pay taxes on time, however, in view of this problem, the government extends the last date and one such important step has recently been taken by the Kenya Revenue Authority where citizens are being given time till 5 July 2025 to file itax.

No tax on Social Security? Why It’s Not in Trump’s Big Beautiful Bill

D-SNAP Florida 2025: Check Disaster Food Stamps Eligibility, Amount and How to Claim?

Last date to File Tax on ITax Portal

For the information of the readers, let us tell you that this additional time is being provided by the Kenya State Government only because on June 30, the itax portal started showing technical glitches due to tremendous load and taxpayers were deprived of paying taxes till the last date. The deadline is being extended so that people do not have to bear the brunt of this technical error. However, taxpayers who will not be able to pay tax on time due to business and/or personal reasons or file tax after 5 July will have to pay additional interest and penalty.

Objectives of Extending Kenya Revenue Authority changes 2025

Kenya Revenue Authority has now extended the tax payment period from 30 June to 5 July as the itax portal was unable to login and file due to heavy traffic, due to which many taxpayers were unable to pay taxes on time. So that citizens do not have to suffer any kind of loss due to technical glitches on the government portal, the government has now decided to provide additional time to the citizens by being sensitive so that citizens can file returns on time. This important decision increases the trust of citizens in the Kenya Revenue Authority even more. Along with this, taxpayers are being given relief by considering technical difficulties as the main reason, in such a situation, taxpayers will no longer have to pay additional interest or penalty.

What will Happen if a Citizen is Unable to File Tax on Time?

Although the last date for paying tax was 30 June 2025, but due to technical glitches, it has now been extended to 5 July 2025. If a citizen is unable to pay tax on time even by 5 July 2025, then he will have to pay a penalty of 5% or 2000 Kenyan shillings for filing tax late. At the same time, if the tax is not deposited on time, they will be charged an additional 1% interest per month.

Along with this, it is possible that in future these citizens may also be deprived of government services such as their licenses may be canceled, government tenders may be canceled, they may not be provided loans etc. Apart from this, if a citizen is unable to pay tax on time, then he does not get the benefit of government facilities. Even their payment record gets spoiled due to which banking activities are also affected.

How to Fill This Return

To fill this return, different taxpayers will have to keep different documents ready, Salaried people need P9 form, mortgage and life insurance certificate, exemption statement and People earning income from business or rent need sales or income receipt, advance tax Withholding proof Farmers need agricultural sales and expenditure records, inputs and contracts Students and unemployed people will have to enter only the active PIN number.

Karunya KR 709 Kerala Lottery Results, Lucky Draw DECLARED – Check Full Winners List

How to File Tax On ITAX

- Tax can be filed through the ITAX portal.

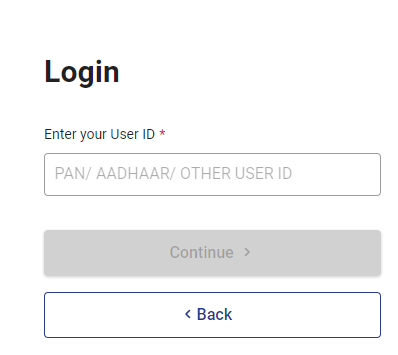

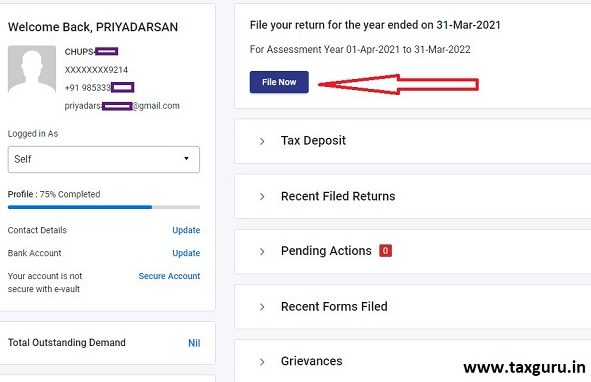

- First of all, all citizens have to login to the ITAX portal with their PIN and password.

- After logging in to the portal, they have to click on the option of file now.

- After clicking here, they have to select the taxpayer option in their profile such as individual, business farmer etc.

- After this, the taxpayer has to fill the details of income and deductions.

- After filling all the details, they have to check it carefully once again and upload it after validating it.

- After this, the taxpayer has to click on the submit option and download the acknowledgement receipt.

Conclusion

If you are a citizen of Kenya and have missed paying the tax for the year 2024, then you can also pay your taxes by visiting the ITAX portal by 5 July 2025 and avoid penalty and interest by filing the return. For more information, you can visit the ITAX portal or can also get help through ITAX helpline or email.