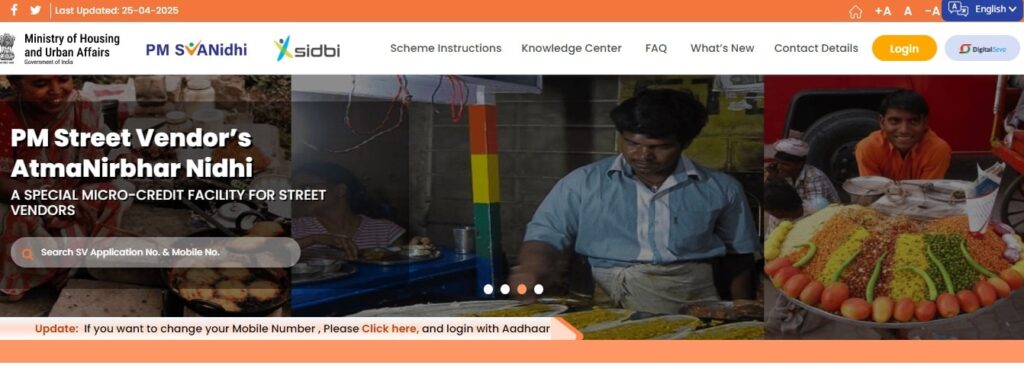

PM SVANidhi Scheme 2025: Central government is offering business loan to the Indian citizens under PM SVANidhi Scheme 2025. This scheme is designed for micro and medium business startups in India including the local vendors. So if you are also one of them then you can check the specific eligibility criteria for PM SVA Nidhi scheme 2025 and after that can apply online accordingly. We have mentioned all the documents in this article which will be asked by the government at the time of approving the loan amount.

PM SVANidhi Scheme 2025

PM SVA Nidhi Scheme was firstly launched in 2020 during the Coronavirus pandemic. It was started to provide financial assistance to the local vendors including fruit and vegetable vendors, Shoes vendors etc. These beneficiaries can apply for Rs 50000 instant business loan from PM SVANidhi scheme 2025 and after that they will get instant approval on their loan amount. The PM SVANidhi scheme 2025 is open to anyone over the age of 18.

Benefits of PM SVANidhi Scheme 2025

There are three types of loan facilities available in SVANidhi loan scheme of Central Government of India where if vendor apply for first time then they can get up to maximum 10000 rupees instant loan. After repayment the loan amount applicants can apply for 20000 for second time and after paying this amount applicant with eligible to get Rs 50000 rupees and loan. All the banks which are participating in SVANidhi loan scheme can provide facilities of loan to their customers. Most of the banks are charging up to 12% interest rates from their customer on Pradhanmantri SVANidhi Yojana. But government will give the relief of 7% subsidy on the interest rates so applicants have to pay only 5% annual interest on the loan amount. It is very fruitful scheme for all the vendors in India engaged in different businesses.

Eligibility Criteria For PM SVANidhi Scheme 2025

- Only Indian citizens are eligible to get instant PM SVANidhi loan 2025.

- Age of the applicant should be between 18 years to 60 years and the time of applying.

- The vendor should be linked with the government and should have a certificate from a board.

- The vendor should have participated with local body Survey Of vendor by the central government

- Mobile number of the applicant should be linked with their bank account and Aadhar card also

Document For PM SVANidhi Scheme 2025

Applicants have to carry the following documents At the time of applying for PM SVANidhi loan scheme 2025:

- Latest passport size photograph of the applicant

- Bank passbook

- Aadhar card of the applicant

- PAN card of the applicant

- Document related to the vendorship.

Step-by-Step: How to Apply

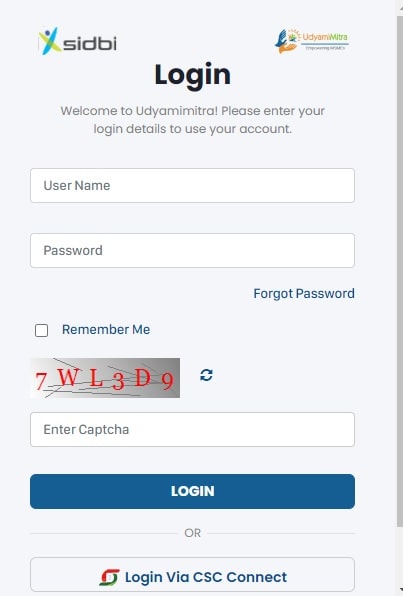

Online Application (via PM SVANidhi portal)

- Go to Official Website pmsvanidhi.mohua.gov.in

- Select vendor category and enter Survey Reference Number (SRN)

- Fill the form, upload documents

- Submit; loan processed & disbursed post-verification

Karunya KR 709 Kerala Lottery Results, Lucky Draw DECLARED – Check Full Winners List

Post Office Monthly Income Scheme 2025: 7.4% ब्याज की गारंटी हर महीने मिलेगा तय ब्याज

Offline Application

- Go to nearby bank branch where you hold a savings account

- Discuss PM SVANidhi loan facility & collect application

- Attach documents and submit form

- Post-verification, loan credited to your account

FAQs about PM SVANidhi Scheme 2025

Who can apply?

Urban/peri-urban street vendors 18–60 years old, vending since before 24 March 2020, with valid vendor ID or LoR.

How are loans disbursed?

Initial ₹10,000; upon repayment, ₹15,000–₹20,000; then ₹30,000–₹50,000; credit card (₹30,000).

What are the interest rates?

7% subsidy provided; net interest around 5%. No charges for timely repayment.

Collateral required?

None. EMI repayment only.

Can I apply offline?

Yes—via banks or CSCs. Online application is also available.